|

CDx3

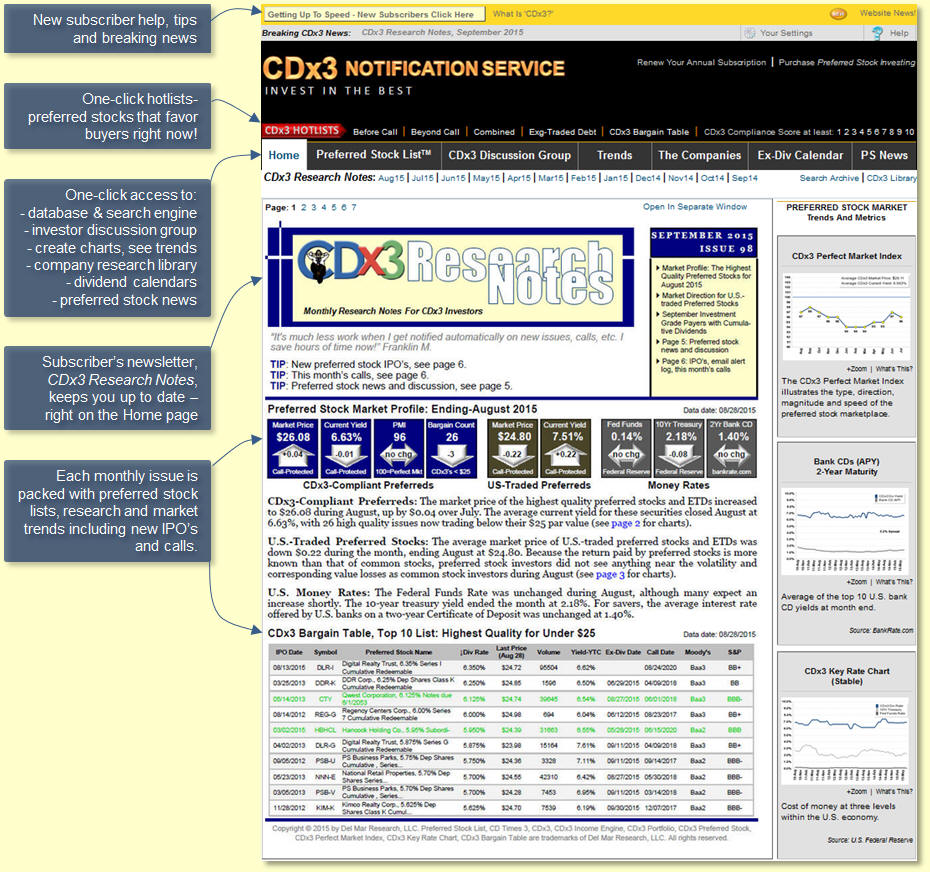

Notification Service Website - Home Page

THIS FEATURE TUTORIAL IS UNSECURED AND

AVAILABLE TO THE GENERAL PUBLIC

You can think of the

CDx3 Notification Service website as your own automated research

assistant; it reaches out across the Internet for information related

to preferred stocks and makes it available to you in one place -

real-time information happening today as well as historical archives.

The CDx3 Notification Service website allows you to know your preferred

stocks (including Exchange Traded Debt Securities), the companies that

issue them and the events that are affecting the marketplace that they

trade within - right now.

The site's design comes

directly from the suggestions submitted by subscribers on their

Continuous Improvement Program surveys. The most popular features

occupy the main menu bar for quick access.

New subscribers should

be sure to click on the Getting Up To Speed button in the upper-left

corner. A new window will open on your screen with tips designed to

help you get started quickly.

After you sign onto the

CDx3 Notification Service website, you will see the website Home page.

Hot Lists are predefined

lists of the highest quality preferred stocks and Exchange Traded Debt

Securities (EDTS). Clicking on a Hot List launches our Preferred Stock

ListTM software application (the most

powerful tool available for preferred stock investors) showing your Hot

List of preferred stocks.

For each preferred stock

Preferred Stock ListTM presents a

variety of information (ex-dividend date, current market price, volume,

Moody's and S&P ratings, trading symbol, IPO date, call date and

much more). All columns can be sorted and data can be downloaded and

saved in Watchlist or spreadsheet format. You can also create your own

Hot List of preferred stock trading symbols for later retrieval (see

the Preferred Stock ListTM tutorial for instructions).

Before

Call - Lists preferred stocks and Exchange-Traded Debt

Securities (ETDs) that meet all ten CDx3 Selection Criteria from Preferred

Stock Investing (CDx3 Compliance Score = 10) and are call protected

(yet to reach their respective call dates). These are the highest

quality preferred stocks available on U.S. stock exchanges.

Beyond

Call - Lists preferred stocks and Exchange-Traded Debt

Securities (ETDs) that meet all ten CDx3 Selection Criteria from Preferred

Stock Investing (CDx3 Compliance Score = 10) and are now callable

(they can be retired by the issuing company at any time). The price of

a preferred stock that the market thinks is about to be called behaves

differently than that of a preferred that has yet to reach its call

date.

Combined - This Hot List combines the previous two Hot Lists

into one so that these high quality issues (CDx3 Compliance Score = 10)

can be viewed and analyzed together in a single list.

Exg-Traded Debt - Lists Exchange Traded Debt Securities (ETDS)

that meet all ten of the CDx3 Selection Criteria from Preferred

Stock Investing (CDx3 Compliance Score = 10). ETDS's will

frequently be referred to as preferred stocks since they are extremely

similar. But these securities can represent lower investment risk than

the same company's preferred stocks since ETDS's are bonds that trade

on the stock exchange (rather than on the bond market). ETDS's are

recorded on the company's books as debt rather than equity (e.g.

preferred stocks).

CDx3

Bargain Table - Lists the highest quality preferred stocks

(regardless of dividend rate) that meet an additional criteria that

make the resulting issues ripe for purchase. These are the highest

quality preferred stocks that are available for less than their par

price ($25.00 per share) right now. Buying preferred stocks for less

than $25.00 per share provides the buyer with an added layer of

principal protection since shareholders will receive $25.00 per share

in the event that the issuing company retires the shares (which also

positions the buyer for a downstream capital gain on top of the great

dividend income in the meantime). The CDx3 Bargain Table is sorted by

the Dividend Rate (coupon) column, highest to lowest, and shows you

what the market is offering in the below-$25 price range.

CDx3

Compliance Score at least - Lists

securities that are at a certain quality level or higher in one mouse

click. Each security in our Preferred Stock ListTM database

has a "CDx3 Compliance Score" (1 through 10) that indicates how many of

the ten CDx3 Selection Criteria the security is able to meet.

Securities that are able to meet all ten of the CDx3 Selection Criteria

("CDx3 Preferred Stocks") have a CDx3 Compliance Score of 10. Click on

any score value to see a list of preferred stocks and Exchange-Traded

Debt Securities that have a CDx3 Compliance Score at the level you

clicked on or higher. When viewing lists of preferred stocks, just

hover your mouse over any trading symbol and a small window will open

showing you its CDx3 Compliance Score (the security's weaknesses will

be highlighted in red).

We publish two preferred

stock research newsletters every month: (1) the non-promotional CDx3

Research Notes just for subscribers to the CDx3 Notification

Service and (2) the CDx3 Newsletter which is available for free

to the general public and promotes our products and services.

The Home page presents the

first page of the current issue of the subscriber's newsletter,

CDx3 Research Notes. Clicking on the page numbers seen just above

the first page image presents subsequent pages of the newsletter. An

archive of the previous twelve monthly issues is also available here.

Want to get a hardcopy?

Clicking on the Open In Separate Window

link that you see just above the top-right corner of the newsletter

page image will open a separate window on your screen and display the

current issue of CDx3 Research Notes in PDF format. Using that

window, you can print the newsletter, resize the pages for easier

reading or download a copy to your computer.

The CDx3 Library link

presents a collection of CDx3 Special Reports (single topic research

papers for preferred stock investors - free to subscribers), a link to

the current issue of our free CDx3 Newsletter and a link to the

website of the book, Preferred Stock Investing.

The Trends and Metrics

charts allow you to see key indicators of the preferred stock

marketplace. Clicking on the +Zoom link below each chart displays a

larger image while the What's This? link opens a separate window with

an explanation of the chart.

Three charts are presented

in the Preferred Stock Market Trends and Metrics:

CDx3

Perfect Market Index - The value of the CDx3 Perfect Market

Index reacts to preferred stock market events. A value of 100 is a

theoretical 'perfect market' for CDx3 Preferred Stocks. When the

preferred stock market is 'perfect' the average market price of a

specifically defined sample of CDx3 Preferred Stocks will be $25.00 per

share. A value greater than 100 indicates a market favoring buyers

(average prices are less than $25) while an index value less than 100

indicates a market favoring sellers (prices are higher than $25). By

calculating and charting the index each month, we can see (1) the type

of preferred stock market we are in (buyer's or seller's), (2) the

direction of the market, (3) the magnitude of the change in the market

from one month to the next and (4) the speed of that change over time.

Savvy preferred stock investors know that preferred stock investing

strategies vary depending on whether we are in a buyer's market or a

seller's market (as described throughout Preferred Stock Investing).

Bank CDs - Preferred stock investors favor fixed-income

investments such as preferred stock, bonds and bank Certificates of

Deposit (CDs). This chart illustrates the spread between the 'going

dividend rate' being offered by the newest CDx3 Preferred Stocks and

the average annual percent yield (APY) offered by the top ten 24-month

bank CDs in the United States (source: BankRate.com). This

spread, by the way, is where the 'CD Times 3' Income Engine gets its

name.

CDx3

Key Rate Chart - This chart shows the 'cost of money' at three

different levels within the U.S. economy. At the bottom, closest to the

source, is the federal funds rate as set and managed by the Federal

Reserve. Next up the chart is the ten-year treasury note yield. This

value is computed by averaging the daily yields throughout the month

for this bond. The top line shows the average dividend rate being

offered by the most recently introduced CDx3 Preferred Stocks.

Presenting these three values on one chart allows us to see the cost of

money set within our banking system and the reaction to this and other

events in the bond and high quality preferred stock markets.

|