|

Table of Contents (click on any topic)

'Securities To View'

Drop-down Menu Functions

Loading preferred stocks into the 'View

Table'

Viewing checked

rows

Creating your own filter - the PSL

search engine

Loading

securities from your watchlist

Loading

securities from your Call Alert List (CDx3 Notification Service

subscribers only)

Entering or

editing the symbols to be viewed

'Hover and Click' Features

Viewing

the CDx3 Compliance Score

Viewing price

charts (two types)

Viewing rate of

return calculations and using the yield calculator

Viewing dividend

history

Working With Your List

Searching for a specific preferred

stock or company

Sorting

Identifying securities with Qualified

Dividend Income (QDI) status

Identifying

called (redeemed) securities

Identifying

securities with suspended or deferred dividends

Selecting a yield

calculation (Current Yield, Yield-To-Call, Effective Annual Return)

Refreshing "perishable" data in the

'View Table'

Printing a hardcopy

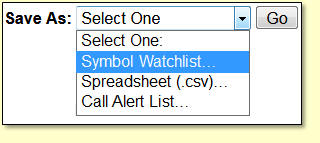

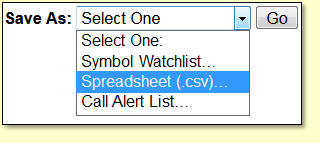

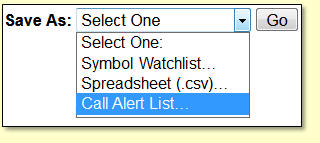

'Save As' Drop-down Menu

Functions

Saving a symbol watchlist

Saving a

spreadsheet (.csv format)

Saving a

Call Alert List (CDx3 Notification Service subscribers only)

Preferred Stock ListTM

disclaimer

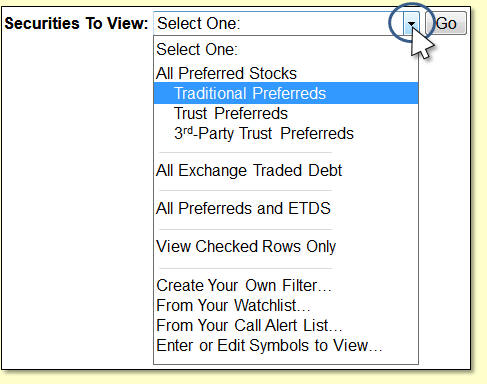

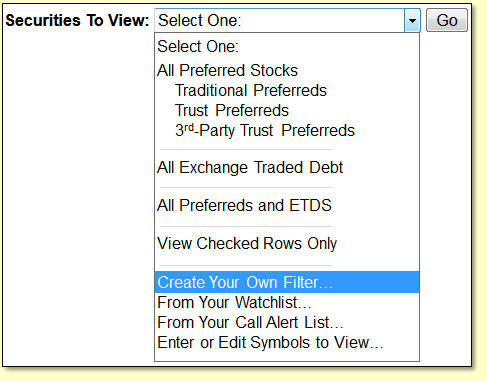

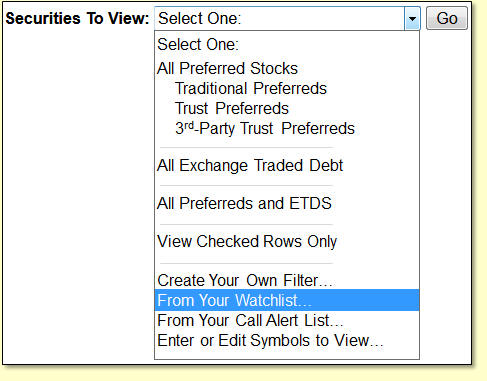

'Securities To View' Drop-down Menu Functions

Preferred Stock ListTM allows you to perform massive

data gathering of the 1,000 to 2,000 U.S.-traded preferred stocks and

Exchange Traded Debt Securities or just one preferred stock that you

are interested in or everything in between.

Using the Securities To

View drop-down list, you can see that Preferred Stock ListTM has a total of ten options for loading

securities into the View Table.

The first six (All Preferred Stocks, Traditional

Preferreds, Trust Preferreds, 3rd-Party Trust Preferreds, All Exchange

Traded Debt, All Preferreds And ETDS) are pre-defined while the last

five (View Checked Rows Only, Create Your Own Filter, From Your

Watchlist, From Your Call Alert List and Enter or Edit Symbols To View)

allow you to control which specific securities are displayed.

To make a selection from the Securities To View drop-down

list, just click on your selection then click the Go button.

When the data you have requested is initially displayed in the View

Table it will be sorted by IPO Date. Data loading times vary with

browser and connection speed.

Let's load some data

into the View Table. Let's load some data

into the View Table.

Click the small down-arrow to drop down the list of

Securities To View, click Traditional Preferreds then click the Go

button.

All traditional preferred stocks trading on U.S. stock

exchanges will load into the View Table.

Your web browser will display indicators that Preferred

Stock ListTM is

loading data. Depending on which web browser you are using (Internet

Explorer, Firefox, Safari, etc.), these indicators are slightly

different. Most display a message at the bottom of the screen while

data is being loaded along with some type of animated spinning graphic.

Clicking screen objects during the data download process will slow (and

perhaps even terminate) the task, so please be patient and wait until

all of the loading indicators and messages that your browser presents

have disappeared.

Loading the View Table with Traditional Preferreds takes

about 5 seconds before it is completely finished.

Now that we have some data in the View Table, let's

review a few of the program's features. After that we'll go over how to

save data from the View Table onto your computer.

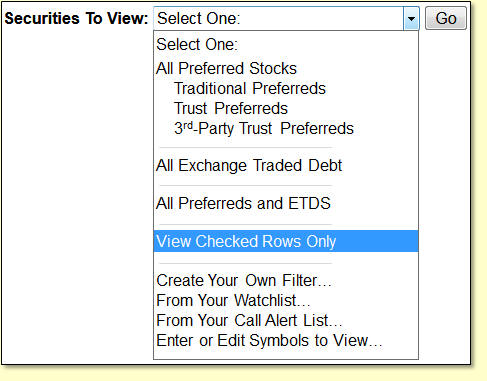

The View Checked Rows Only option works in combination

with the checkboxes that you see at the front of each preferred stock

row in the View Table.

Using this option is

a two-step process. Using this option is

a two-step process.

First, select the individual preferred stocks that you

are interested in by clicking on the checkbox in front of each row.

Once you have checked the preferred stocks of interest,

select the View Checked Rows Only option and click the Go button.

After confirming that you want to view just the checked

rows, the View Table will refresh and present just the preferred stocks

that you selected with the checkboxes.

Before proceeding with an example of how to use

checkboxes, load the View Table with "All Preferreds and ETDS" (select

it from the drop-down list and click the Go button).

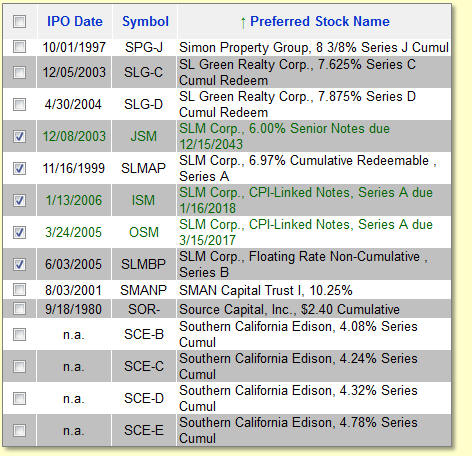

With All Preferreds and ETDS loaded into the View Table,

let's look at an example of using checkboxes.

Let's say you are interested in securities issued by SLM

Corporation. To group them together, sort the View Table by the

Preferred Stock Name column (click the column heading), then click the

checkboxes next to each SLM security as seen here.

Notice in this example that some of the rows are black

and some are green. Preferred Stock ListTM uses

black for preferred stocks and green for Exchange Traded Debt

Securities. SLM Corporation has issued both types of these fixed-income

securities.

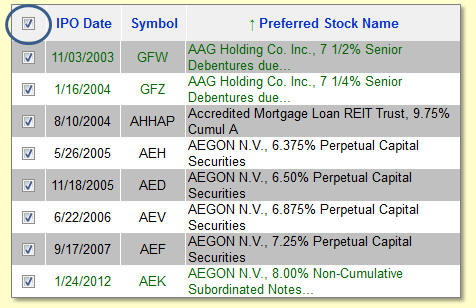

With the checkboxes of the rows that you are interested

in checked, selecting the View Checked Rows Only option in the

Securities To View drop-down list refreshes the View Table with just

the securities that you have checked.

Before

we leave our discussion of using the checkboxes, notice the checkbox in

the upper-left corner next to the IPO Date column heading. Before

we leave our discussion of using the checkboxes, notice the checkbox in

the upper-left corner next to the IPO Date column heading.

This "master checkbox" allows you to check or uncheck all

rows in the View Table at once. This feature can be particularly handy

when you want to check all rows except just a few.

By clicking the master checkbox, all rows in the View

Table will become checked. You can then uncheck the specific rows you

want to remove.

Clicking the master checkbox a second time unchecks all

rows.

While there are only

three types of preferred stocks (traditional, trust and 3rd-party

trust), each security can have a variety of characteristics as

specified in the prospectus. And the same is true for Exchange Traded

Debt Securities (ETDs). While there are only

three types of preferred stocks (traditional, trust and 3rd-party

trust), each security can have a variety of characteristics as

specified in the prospectus. And the same is true for Exchange Traded

Debt Securities (ETDs).

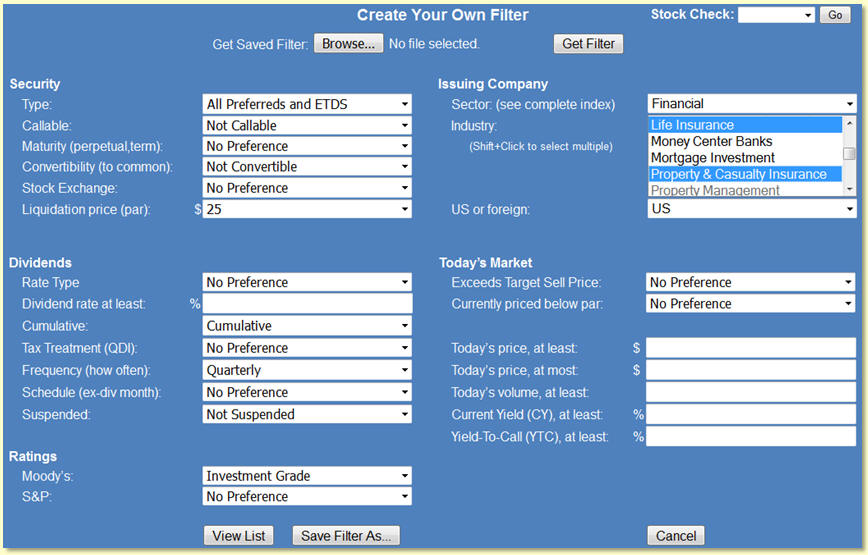

The Create Your Own Filter option allows you to use up to

twenty-five characteristics of preferred stocks and ETDs to create your

own filter.

For example, you can generate a list of all investment

grade preferred stocks with cumulative dividends that are currently

trading for a market price that is below their $25 par value. Or you

can see all non-cumulative preferred stocks that have an investment

grade rating from Moody's and S&P with a current yield over 7%. Or

you can produce a list of all preferred stocks and ETDs that are issued

by real estate companies (REITs) with a market price in a certain

range.

The combinations are endless. Since each of the

characteristics seen here have multiple values to pick from, you can

tighten your filter down as much, or as little, as you would like in

order to see just the securities that you are interested in.

Creating A Filter

The following page will appear when you select the Create

Your Own Filter option from the Securities To View drop-down menu.

To create a filter, use the field next to each parameter

to specify the desired value. You can specify as many or as few

criteria as you would like.

Most of the values that you can select from are

self-explanatory but here are a few tips that should make using the

Create Your Own Filter page a snap.

Dollar amounts are entered without the dollar sign

and without any commas. For example, if you wanted to see securities

that have a current market price of at least a thousand dollars you

would enter 1000.00 in the "Today's price, at least" field.

Percentages are entered without the percent sign

(%). For example, if you wanted to see securities that have a coupon

value of at least 6.5 percent you would type 6.5 for the "Dividend rate

at least" value.

Industry/Sector classifications follow the simplified Morningstar classification

index as implemented at Yahoo Finance. Every security in our

Preferred Stock ListTM database includes this

coding for the issuing company's business sector and industry. When you

select a sector on the Create Your Own Filter page, the industry list

will automatically populate with the industries for the sector you

selected. While the industry list will include all of the industries

for the selected sector, industries that have no preferred stocks will

appear in gray font and cannot be selected. Gray font means that there

are no preferred stocks from that industry. To select multiple

industries, hold the [shift] key down on your keyboard while clicking.

Another tip: Be careful not to create a filter that

includes criteria that are mutually exclusive. Such a filter will

result in a list of zero securities. For example, say you set the

"Today's price, at least" value to 10.00 dollars but then set the

"Today's price, at most" value to 5.00 dollars. These two criteria are

mutually exclusive and would result in a list of zero securities.

Once you have your filter set up, click on the View List

button in the bottom-left corner and PSL will present the list of all

securities that meet the criteria that you have specified.

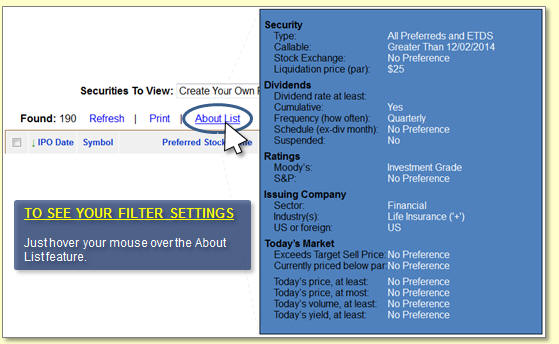

About List

When viewing the securities from your filter, you will

notice that an additional feature appears to the left just above the

column headings.

The About List feature allows you to see the parameters

of your filter without having to return to the Create Your Own Filter

page.

Just hover your mouse over the About List feature and a

pop-up box will open on your screen with the values of your filter that

generated the list.

Note that the About List feature only appears when you

are viewing a list that was generated by the Create Your Filter page.

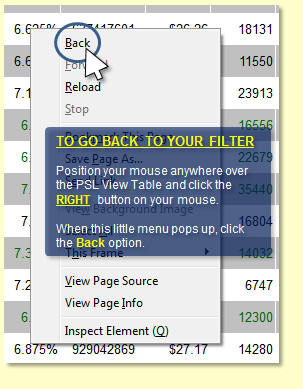

Returning To Your Filter

Once you specify the parameters of your filter and click

the View List button, the securities that qualify for your filter will

be presented.

Your web browser program (Internet Explorer, FireFox,

Safari) has a built-in feature that allows you to return to the filter

page in order to re-visit your parameters.

To return to the Create Your Own Filter page and re-visit

your parameters, position your mouse pointer anywhere within the PSL

frame and RIGHT click your mouse.

Clicking on your RIGHT mouse button will

open a small menu on your screen that includes a Back option. Clicking

the Back option will return you to the Create Your Own Filter page with

your parameters.

Please note that the Back/Previous arrow button located

in the upper-left corner of your web browser window will NOT return you

to your filter page. Use the Back function described in the above

paragraphs instead.

Once you have returned to your filter page and have

reviewed or modified your filter, click on the View List button to see

your list of securities again.

Stock Check

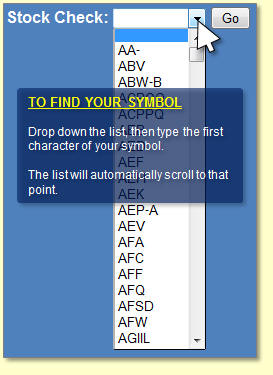

The Create Your Own

Filter page also provides a "Stock Check" feature in the upper-right

corner of the page. The Stock Check feature allows you to see the

characteristics for a specific preferred stock or ETDs. The Create Your Own

Filter page also provides a "Stock Check" feature in the upper-right

corner of the page. The Stock Check feature allows you to see the

characteristics for a specific preferred stock or ETDs.

To use the Stock Check feature, click the small

down-arrow to drop down the list of securities in the PSL database. To

find the security that you are interested in, type the first letter of

its trading symbol and the list will automatically scroll to that

point. Click on the trading symbol for your security then click the Go

button.

The characteristics of the security that you selected

will be displayed.

Upgrade Candidates

Preferred Stock Investing

describes a technique called "upgrading" that allows you to "trade in"

a low dividend paying preferred stock for a higher paying one and have

cash left over when you're done. When upgrading, you will sell your

low-payer and use the proceeds to purchase a higher payer that is

selling for a lower market price than the one you sold.

The Stock Check feature makes finding upgrade candidates

a snap for any preferred stock in your portfolio.

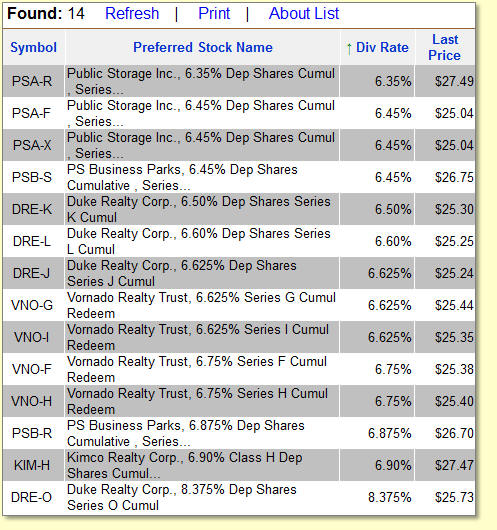

For example, let's say that you own PSA-R from Public

Storage. PSA-R pays a 6.35% dividend (coupon) and is selling for $27.49

(on the day this was written). Use the Stock Check field to retrieve

PSA-R. With PSA-R's characteristics displayed, clear some of the fields

so that the filter is not overly restrictive - when performing an

upgrade what you really want to see is a list of candidates that have a

higher dividend rate and are available for a lower price than the

security you are selling (PSA-R here).

In this example, to see more candidates the following

fields from PSA-R were changed to 'No Preference' or set to blank -

Callable, Schedule, Sector/Industry, Currently priced below par,

Today's volume and Today's yield.

Clicking the View List button will display your upgrade

candidates.

PSA-R meets the characteristics of your filter so it is

listed along with 13 other upgrade candidates (this list is sorted by

Div Rate by clicking on the column heading).

If you sell PSA-R for $27.49, you could buy any one of

the other 13 securities seen in the list and (a) realize an increase in

dividend income and (b) have cash left over since they are all selling

for market prices less than PSA-R's $27.49.

Take a look at DRE-O at the bottom of the list. By

selling PSA-R for $27.49 and using the proceeds to buy DRE-O, you would

increase your dividend return to 8.375% (up from PSA-R's 6.35%) and

have $1.76 per share left over in your brokerage cash account. Whether

or not doing so is consistent with your personal financial goals,

resources and risk tolerance is, of course, a decision that only you

can make.

Using the Stock Check feature is an extremely powerful

way to identify upgrade candidates at any time for the preferred stocks

in your portfolio.

Saving Your Filter

Clicking the Save

Filter As button at the bottom of the page allows you to save your

filter to your computer's hard disk. Clicking the Save

Filter As button at the bottom of the page allows you to save your

filter to your computer's hard disk.

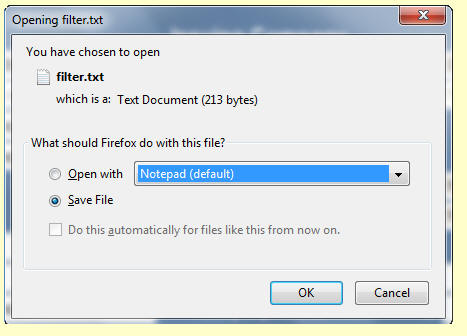

When you click the Save Filter As button, your web

browser program (Internet Explorer, FireFox, Safari) takes over from

our program so the appearance and function of these windows depends on

which web browser program you are using, your computer's operating

system and how you have the preference and other security settings

configured. Our program tells your web browser program to save the

filter file; how it does so is entirely up to your web browser program.

The example at left is from FireFox for Windows.

If you are having difficulty saving the filter file to

your computer, please seek the assistance of a local technical resource

who can work with you to properly configure the technical settings and

preferences of your computer web browser and/or operating system to

properly perform this function.

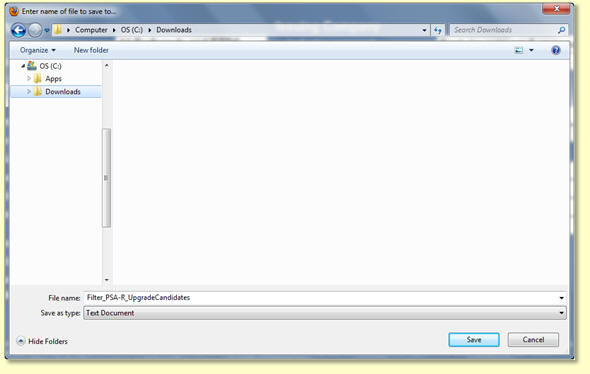

By clicking the Save

File radio button then the OK button, FireFox (in this example) will

present the Save As window that allows you to set your filter file's

name and the location (folder) on your computer's hard disk. By clicking the Save

File radio button then the OK button, FireFox (in this example) will

present the Save As window that allows you to set your filter file's

name and the location (folder) on your computer's hard disk.

The file type is set to use the plain text (.txt) format

which is the format required for filter files. Changing the file type

will prohibit your filter file from being able to be used by the Get

Saved Filter feature. Please do not change the file type when

saving your filter file.

Remember where you save your filter file since you will

need this information again when you want to retrieve your filter using

the Get Saved Filter button.

The From Your

Watchlist option tells Preferred Stock ListTM

that you want it to gather current data for a specific list of trading

symbols that you had previously saved onto your computer (more on how

to save a Symbol Watchlist of trading symbols onto your computer in a

moment). The From Your

Watchlist option tells Preferred Stock ListTM

that you want it to gather current data for a specific list of trading

symbols that you had previously saved onto your computer (more on how

to save a Symbol Watchlist of trading symbols onto your computer in a

moment).

This option is very helpful when you want to keep an eye

on a specific list of preferred stocks over time, such as a preferred

stock portfolio.

Even if your list includes CDx3 Preferred Stocks,

non-CDx3 issues and ETDS's, you can create a Symbol Watchlist of their

trading symbols (more on how to create a new Symbol Watchlist in a

moment) and load them into the View Table at any time.

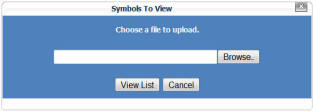

When you select the From Your Watchlist option and click

the Go button, a window will open on your screen that allows you to

designate the file on your computer where you previously saved your

Symbol Watchlist (you can create any number of Symbol Watchlists as

long as you give them unique names on your computer; more on creating

Symbol Watchlists in a moment).

Note that the appearance of this window may be slightly

different depending on the web browser program you are using (Internet

Explorer, Apple Safari, Firefox, etc.).

Use this window to browse your computer's hard disk and

locate the Symbol Watchlist file that you had previously saved (using

the Save

As / Symbol Watchlist option discussed below).

A Symbol Watchlist file contains a list of preferred

stock trading symbols, separated by commas.

Once you have selected the Symbol Watchlist that you want

to view click the View List button. After Preferred Stock ListTM retrieves the data (this may take several seconds)

your screen will be updated with the preferred stocks designated by the

trading symbols within your Symbol Watchlist file.

With your preferred stocks listed, you can also make

changes to your watchlist - add some new symbols, delete others, etc.

To make changes to your symbol watchlist, use the Enter or Edit

Symbols to View option, discussed below.

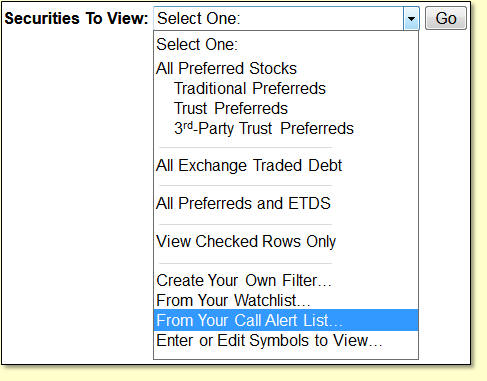

CDx3 Notification Service subscribers are able to create

a 'Call Alert List' of trading symbols. When the issuing company of one

of the securities on your Call Alert List announces a call, you will

receive an email notification from us for that security.

This feature is only available to CDx3 Notification

Service subscribers (when selected, you will be asked to

re-authenticate by entering your CDx3 Notification Service subscription

credentials).

The From Your Call Alert List option tells Preferred

Stock ListTM to retrieve the Call Alert List that

you previously saved in our system (using the Save As /

Call Alert List feature discussed below).

Once the securities within your Call Alert List are

displayed, you can edit the list (add new symbols, delete or change

existing symbols) using the Enter or Edit Symbols to View option

(discussed next).

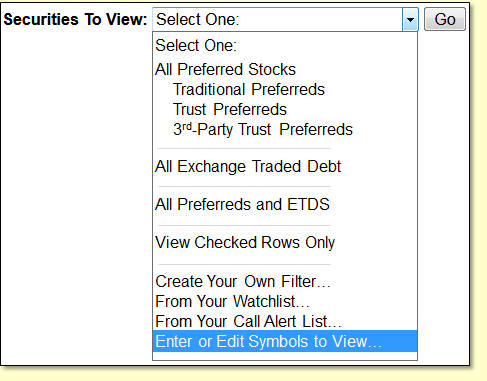

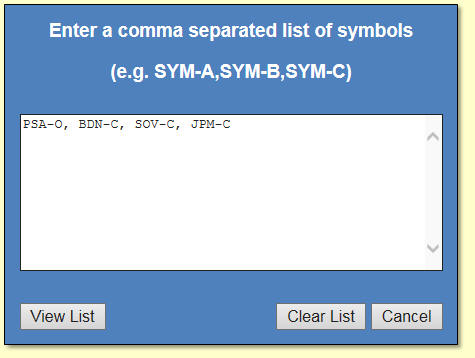

When you select the

Enter or Edit Symbols To View option and click the Go button, a page

will open on your screen where you are able to manually designate which

preferred stocks you would like to list, using their trading symbols. When you select the

Enter or Edit Symbols To View option and click the Go button, a page

will open on your screen where you are able to manually designate which

preferred stocks you would like to list, using their trading symbols.

If you are using this option to set up a long Call Alert

List for the first time (lots of symbols you don't particularly want to

type), see the special time saving tips below.

If you were viewing a list of preferred stocks at the

time you selected this option (from a Symbol Watchlist or from your

Call Alert List, for example), the trading symbols of the preferred

stocks you were viewing will automatically appear in the edit box on

this page.

Use the edit box to make any additions, deletions or

other edits to the trading symbols listed there or click the Clear List

button to start over with a clean slate.

Be sure that the trading symbols in the edit box are

separated by commas.

You

can have as few or as many symbols in the edit box as you would like

but remember that the more you enter the longer it will take Preferred

Stock ListTM to gather all of the information.

Trading symbols can be entered either in UPPERCASE or lowercase letters

and can be for either preferred stocks, ETDS's or both. You

can have as few or as many symbols in the edit box as you would like

but remember that the more you enter the longer it will take Preferred

Stock ListTM to gather all of the information.

Trading symbols can be entered either in UPPERCASE or lowercase letters

and can be for either preferred stocks, ETDS's or both.

In this example, the View Table will be loaded with the

information for four preferred stocks - PSA-O, BDN-C, SOV-C and JPM-C.

Once you have typed your symbol list, click the View List

button. After Preferred Stock ListTM retrieves

the data (this may take several seconds) your screen will be updated

with the data for the securities designated by the trading symbols in

the edit box.

Invalid trading symbols will be ignored.

If you have just used the Enter or Edit Symbols to View

option to make changes to a Symbol Watchlist or to your Call Alert

List, don't forget to use the Save As / Symbol Watchlist or Save As /

Call Alert List feature (discussed below) to re-save your newly

updated list.

Here are some time saving tips for creating your Call

Alert List for the first time:

The first time you set up your Call Alert List, you are

likely to have quite a few trading symbols to enter. PSL provides three

methods for creating your Call Alert List, depending on how much typing

you want to do:

Method #1 - Type them using the Enter or Edit Symbols to

View option as discussed above.

Method #2 - List all of the preferred stocks and ETDS in

our database (alphabetically by trading symbol), then use the

checkboxes seen at the beginning of each preferred stock row for the

ones you want alerts for:

- Select the 'All Preferreds and ETDS' option of the

Securities To View drop-down menu (click Go).

- Sort the list by the Symbol column (click the column

heading). The list is now sorted by trading symbol, A to Z.

- Scroll down the list, clicking on the checkbox at the

beginning of each row for the securities you want call alerts for.

- With your securities checked, select the 'View Checked Rows

Only' option of the Securities To View drop-down menu.

The securities (rows) you checked are now displayed in

the View Table. Review your list of securities. If you need to make any

additions or changes, select the 'Enter or Edit Symbols to View' option

and edit your list of symbols. Once your list is the way you want it,

save it as your Call Alert List by selecting the 'Call Alert List'

option on the Save As drop-down menu.

Method #3 - Import your trading symbol list from an Excel

spreadsheet file (csv format). This tip is just for those who are

proficient with using a spreadsheet program (e.g. Excel) to create a

csv file. PSL's 'Securities To View / From Your Watchlist'

option will import a csv file of trading symbols from your computer

directly into the View Table. At that point, you can use the Save As /

Call Alert List option to save your Call Alert List. When using

your spreadsheet program to create a csv file of your trading symbols,

be sure that your trading symbols are all on row 1 across your screen

(one symbol per cell; no other content), left to right horizontally

(NOT as a column down your screen vertically, see special note below).

With your symbols now displayed across your screen on row 1 of your new

spreadsheet, save your new spreadsheet as a csv file type. To turn your

csv into a Call Alert List:

- Select the 'From Your Watchlist' option of the

Securities To View drop-down menu (click Go).

- Browse your computer and select your csv file of

trading symbols.

- Click the View List button to display the preferred

stocks from your csv file in PSL's View Table.

- Use the 'Call Alert List' option on the Save As

drop-down menu to save your preferred stocks as your Call Alert List.

Special note: If you currently have your preferred stocks

in a spreadsheet, but your trading symbols are oriented vertically (as

a column), use Excel's 'transpose' option on the Paste Special dialog

box to copy/paste your symbol column into cell A1 as a row in a new

spreadsheet.

'Hover and Click' Features

It's just not possible to

display all of the information that the PSL database contains or

otherwise has access to on one screen. By using what we call 'hover and

click' features, you are able to easily and quickly drill down into

vast amounts of additional information about specific preferred stocks

without having to navigate to some other webpage.

All of our hover and click

features work the same way. As explained below, certain (not all)

values that you see on a preferred stock's row in the View Table are

actually spring-loaded with additional information. To access the

additional information you can hover your mouse pointer

(without clicking) over such values and a small pop-up box will appear

with more detail.

Some values also let you

click on them to drill down even further. Clicking your

mouse on such values will open a new tab in your web browser with the

detailed content for the value you clicked on.

Let's take a look at the

hover and click features of our PSL database system, moving from left

to right across the View Table columns.

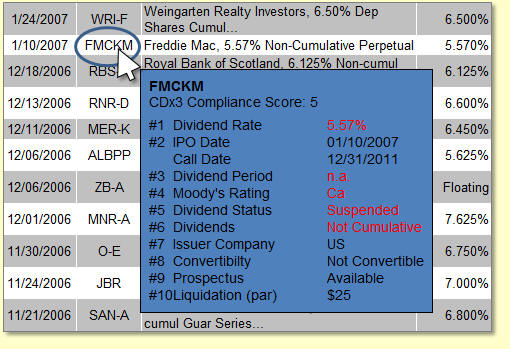

Hovering your mouse (without clicking) over

any trading symbol presents a pop-up box that displays the security's

"CDx3 Compliance Score." You can also click the symbol to open its Spec Sheet in a separate window.

The CDx3 Compliance Score is an indicator of the

security's quality. Preferred Stock Investing

describes a filter used to identify the highest quality preferred

stocks.

The "CDx3 Selection Criteria" filter is composed of ten

specific characteristics. Each security in our Preferred Stock ListTM database has a CDx3 Compliance Score (1 through 10)

that indicates how many of the ten CDx3 Selection Criteria the security

is able to meet.

Securities that are able to meet all ten of the CDx3

Selection Criteria ("CDx3 Preferred Stocks") have a CDx3 Compliance

Score of 10.

This example shows the CDx3 Compliance Score (a very weak

5) for FMCKN, a non-cumulative preferred stock from Freddie Mac with

suspended dividends.

Preferred Stock ListTM displays a

variety of current market data for every preferred stock such as the

last trade price, today's trading volume, current yield and the most

recently declared ex-dividend date.

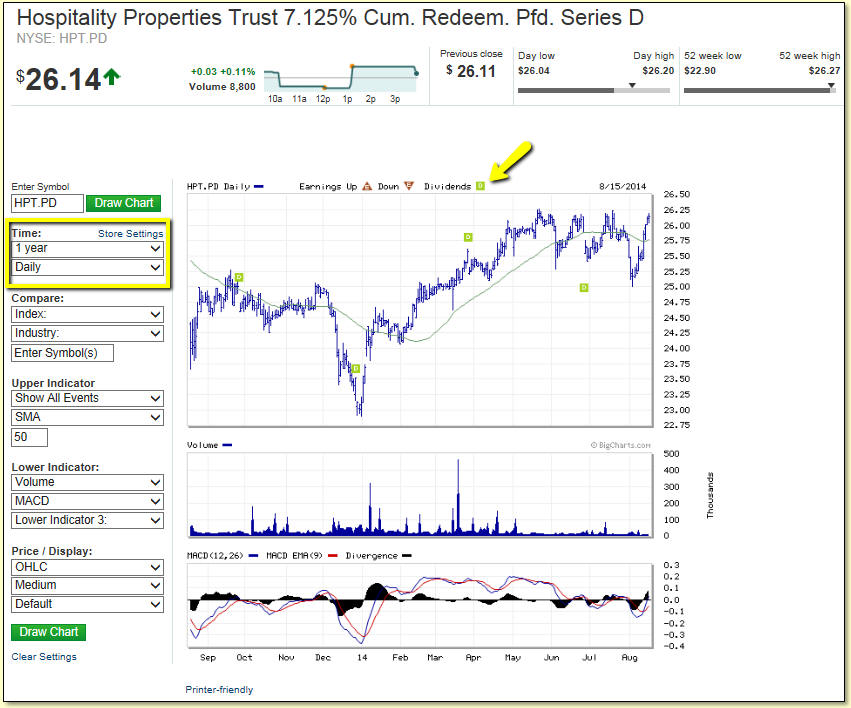

But there's more. There are two types of price charts

that you can view for each security - while one chart shows you a

detailed picture of today's price movement, the second chart is a very

comprehensive, customizable charting tool.

Chart #1 - Today's Price Movement: By hovering

your mouse pointer over the last price of a preferred stock, a pop-up

box will open on your screen showing a chart of today's price movement

(provided by Yahoo.com).

This example shows the price chart during a trading day

for the Series D preferred stock from Hospitality Properties (HPT-D).

The chart updates automatically throughout the trading day.

Below the chart are additional parameters that are useful

to those considering a purchase or a sale. Note too that the Target

Sell Price is also shown for CDx3-compliant securities (i.e. those with

a CDx3 Compliance Score of 10, see "Selling for the Target Sell Price"

described in Preferred Stock Investing).

Chart #2 - Customizable Chart with Dividend History:

While "hovering" your mouse pointer over the last price value displays

today's price movement, actually clicking on the last

price value will open a new tab in your web browser showing you the

price chart over the last year for the security you clicked on

(including the prior day's closing price).

Note that the security's dividend payments are indicated

with a "D" symbol. Payment dates without a D symbol indicated a missed

dividend payment. A security that pays a quarterly dividend should show

four D symbols when viewing a one year price chart as seen in this

example for HPT-D.

But this is much more than a one year price chart; the

page that you see is presented by MarketWatch.com (owned by the Wall

Street Journal) and is a very robust charting tool. By adjusting the

various settings that you see to the left of the chart, you can change

the date range of the chart, compare the price performance of multiple

securities or indexes, change the appearance of the chart, etc.

Not sure what some of the indicators mean? Do a Google

search like the phrase "what does MACD mean?" and you'll learn more

than you ever wanted to know.

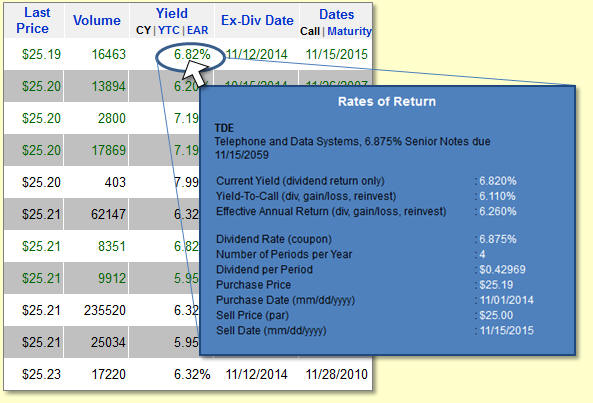

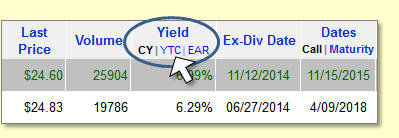

Hovering your mouse pointer (without

clicking) over a value in the Yield column opens a pop-up box showing

the three rates of return for the security (Current Yield,

Yield-To-Call and Effective Annual Return).

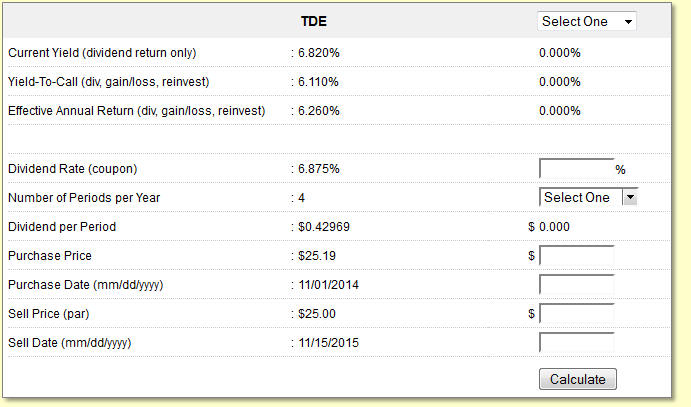

This example of the Yield hover feature shows the pop-up

box that appears when your mouse pointer hovers over the Yield value

for TDE from Telephone and Data Systems.

In addition to showing TDE's three rates of return (CY,

YTC and EAR), the pop-up box also shows the characteristics of the

security that are used in these three calculations.

If there are characteristics of the security that prevent

any of the three rates of return from being calculated, a red message

will appear next to the offending characteristic.

For example, neither YTC nor EAR can be calculated for

securities that have a call date that has passed. For such securities,

the message "Call date has passed" will appear in red font on the "Sell

Date (call date)" line.

Similarly, none of the three rates of return can be

calculated for securities where the last trade price (which is used for

the purchase price) is zero. In cases where the last trade price is

zero, "0.00" will be presented in red font on the "Purchase Price (last

price)" line. Also, the rates of return for preferred stocks that are

not paying dividends (suspended or deferred) cannot be calculated.

Clicking on a Yield value opens a new tab

in your web browser with our rate of return calculator. The Rates of

Return page is a very powerful tool for preferred stock investors and

goes well beyond the functionality of the simple rate calculators that

you may be used to.

The Rates of Return

page is presented with two columns. The left column shows the rates of

return for the preferred stock that you clicked on along with the

characteristics that are used in the calculations (TDE in this

example). The Rates of Return

page is presented with two columns. The left column shows the rates of

return for the preferred stock that you clicked on along with the

characteristics that are used in the calculations (TDE in this

example).

The right column is used to select or create a preferred

stock investment that can then be compared to the one you clicked on,

side by side.

Selecting a second preferred stock: To compare a

second preferred stock's rates of return to the one that you clicked on

(presented in the left column), use the "Select One" drop-down list

that you see in the gray title bar.

Clicking on the small down arrow of the Select One

drop-down list will display a scrolling list of the trading symbols for

all of the securities in our PSL database.

Clicking on a trading symbol will select that security

and display its three rates of return plus the characteristics that are

used in the calculations.

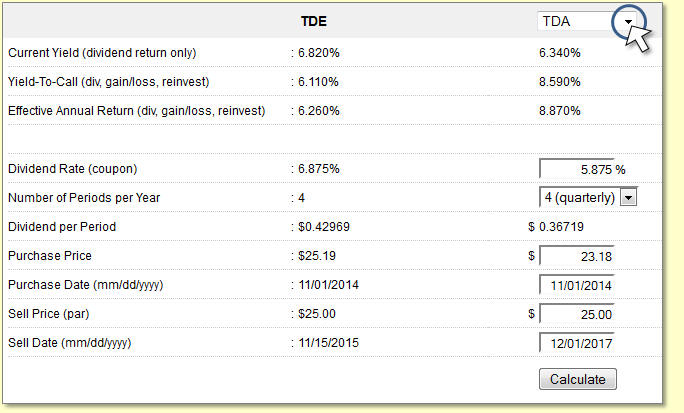

In this example, I have used the Select One drop-down

list to compare the rates of return for TDA, also issued by Telephone

and Data Systems, with TDE.

Creating a second preferred stock: Alternatively,

the right column also functions as a manual rate of return calculator.

Manually entering the six characteristics of a preferred stock

investment that you are considering allows you to compare the rates of

return with the preferred stock you clicked on (TDE in this example)

with the one you have manually set up.

To

use the calculator, just enter the six values and click the Calculate

button. To

use the calculator, just enter the six values and click the Calculate

button.

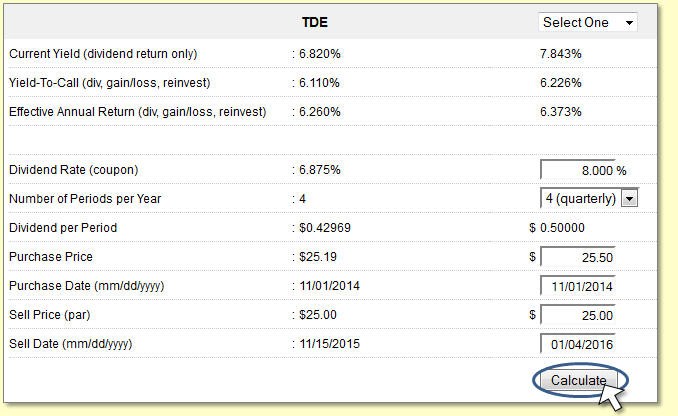

For example, let's say that I want to know if buying a

preferred stock with an 8 percent dividend at $0.50 over par ($25.50)

and holding it until January 2016 would provide me with a greater

Yield-To-Call than buying TDE shares today at $25.19.

After entering the six values for the 8 percent preferred

stock that I am considering, clicking the Calculate button presents the

Current Yield, Yield-To-Call and Effective Annual Return.

Notice that the YTC of our fictitious preferred stock

will be 6.226 percent compared to TDE's 6.110 percent. If YTC was the

only consideration, the calculator tells me that I would be better off

investing in the 8 percent alternative than buying TDE shares, even if

it means taking a larger capital loss in the event of a call in January

2016.

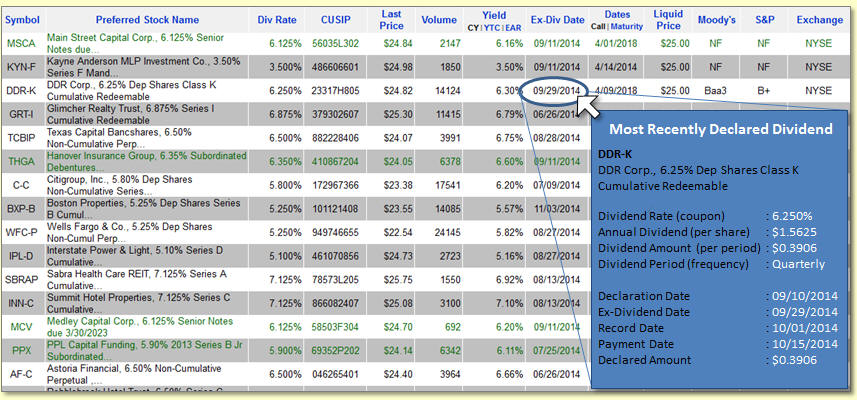

Hovering your mouse pointer (without

clicking) over an ex-dividend date opens a pop-up box showing key

information about the most recently declared dividend for the security

that your mouse is hovering over.

Take a look at this example of the hover feature using DDR-K from DDR

Corporation.

Clicking on the ex-dividend date opens a

new tab in your web browser displaying the dividend history for the

security you clicked on.

Working With Your List

When you use the Securities

To View drop-down menu to load preferred stocks into the View Table,

the PSL system allows you to perform a variety of common tasks such as

searching the list for a specific security or company, re-sorting the

list, refreshing the market data (such as the last price and volume) or

printing a hardcopy on your printer.

There are several methods that you can use to search the

PSL database for a specific security using the trading symbol, CUSIP,

company name or just about anything else.

Method #1: Using the Securities To View

drop-down menu, select the Enter or Edit Symbols to View

option. A page will open where you can enter a list of one or more

preferred stock symbols to find.

Method #2: With the list of securities that you

want to search displayed in the View Table, click on your browser's

Edit menu and use the Find option. A search box will open for you to

enter what you want to search for (e.g. a trading symbol, company name,

CUSIP or anything else). If the security you specified is found within

the displayed list, your browser will scroll the list to that

security's row and highlight it. If you want to search the entire PSL

database, use the Securities To View drop-down menu and select the 'All

Preferreds and ETDS' option to populate the View Table before

performing your search.

You can also use your browser's Find function from the

keyboard rather than using the Edit menu. Just hold your [ctrl] key

down and type the letter f. The search box will open where you can

enter the text to search for.

Method #3: The 'Create Your Own Filter' page allows

you to search the PSL database for preferred stocks that meet up to 25

characteristics or a specific preferred stock using its trading symbol.

To access the Create Your Own Filter page, use the Securities To View

drop-down menu and select the Create Your Own Filter option. The 'Stock Check'

feature seen in the upper-right corner of the Create Your Own Filter

page allows you to quickly retrieve the data associated with a specific

preferred stock.

Here's another tip: If you are looking for a list of

preferred stocks issued by a specific company, use 'The Companies' tab

that you see in the CDx3 Notification Service menu bar. The Companies

tab presents an alphabetized list of all companies that have preferred

stocks and ETDs currently trading on U.S. stock exchanges and shows the

list of securities issued by each company. You can also search the list

of companies seen on The Companies tab by common stock trading symbol.

Note that the column headings in the View Table are blue.

That means that you can click them to control how the View Table is

sorted.

When the preferred stocks that you request first appear

in the View Table they will be sorted by IPO Date (most recently

introduced issues will be listed first). Clicking any column heading

will sort the View Table in ascending order (smallest value first) by

the column you clicked. Clicking the column heading again will re-sort

the View Table again but in descending order.

Remember that Preferred Stock ListTM

is a data gathering tool rather than a data analysis tool. To perform

more complex sorting you should save the data as a spreadsheet and use

a spreadsheet program (such as Microsoft Excel, OpenOffice or similar).

We'll review how to save the View Table as a spreadsheet onto your

computer in a moment.

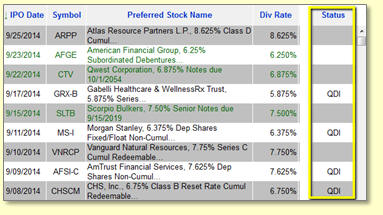

Income

securities that have been designated as having Qualified Dividend

Income (QDI) status are indicated in the Status column of our PSL

database with the letters "QDI". Income

securities that have been designated as having Qualified Dividend

Income (QDI) status are indicated in the Status column of our PSL

database with the letters "QDI".

The dividends that you receive from some preferred stocks

qualify for a special tax rate that is generally more favorable.

Dividend income that qualifies for this special tax treatment is

referred to as Qualified Dividend Income (QDI).

This example shows nine securities, four of which have

the QDI designation in the Status column (extraneous columns have been

removed here for clarity).

If you want to see all QDI securities in your list, just

sort your list by clicking on the Status column heading and all

QDI-designated securities in your list will group together for you.

Preferred stock investors should be careful to note that

even though the IRS is the enforcement agency when it comes to the QDI

designation of your dividend income, they have declined to publish an

official list of securities that are QDI-compliant. While the IRS

publishes the criteria for QDI compliance, they will not publish a list

of securities that meet those criteria. Rather, in the event of an

audit, the IRS will make a determination of any income you are claiming

to be QDI-qualified.

Consequently, please note the special footnote at the

bottom of the PSL frame which notes that the QDI designation that you

see in our PSL database (and from any other website or other source

other than the IRS) is unofficial and reminds you that you

should seek the advice of a tax professional regarding the QDI

compliance of your dividend income.

Those subscribed to our CDx3 Notification Service program

can quickly see a list of securities that are being called by their

issuer by clicking on the PS News tab on the CDx3 Notification Service

website. The PS News tab allows CDx3 Notification Service subscribers

to view IPOs and calls in one mouse click.

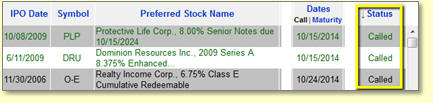

Our PSL program also allows you to see securities that

are being called. The Status column will display the word "Called" in

the event that the issuing company announces a call (a.k.a. redemption)

for the security. To see all securities in your list that have a call

pending, just sort your list by clicking on the Status column heading

and all called securities in your list will group together for you.

Similarly, to see all preferred stocks and ETDs

that currently have a call pending, use the Securities To View

drop-down menu to load "All Preferreds and ETDS" into the View Table

then sort the list by clicking on the Status column heading. All

securities with a pending redemption will be grouped together for you.

For securities with a pending call (i.e. where the word

"Called" appears in the Status column), the date seen in the security's

Call Date column will present the date of the announced redemption

(this is the date that the issuing company will purchase the shares

back from shareholders in exchange for cash).

In this example, PLP

from Protective Life and DRU from Dominion Resources (both ETDs) have

been called for October 15, 2014. Realty Income has also announced the

redemption of its O-E traditional preferred stock for October 24,

2014 (extraneous columns have been removed here for clarity). In this example, PLP

from Protective Life and DRU from Dominion Resources (both ETDs) have

been called for October 15, 2014. Realty Income has also announced the

redemption of its O-E traditional preferred stock for October 24,

2014 (extraneous columns have been removed here for clarity).

Once a security is called and is no longer trading it is

removed from, and will no longer appear within, our PSL database.

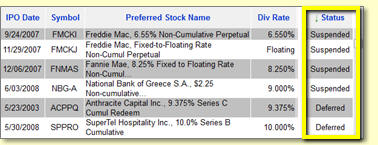

The Status column will display the word "Suspended" or

the word "Deferred" in the unlikely event that the issuing company is

unable to make the upcoming dividend payment to shareholders.

The difference between a preferred stock with suspended

dividends and one with deferred dividends can become very important to

preferred stock investors so our PSL database program makes the

distinction clear in the Status column.

Prospectus language for preferred stocks with

"non-cumulative" dividends will often use the term "suspend" when

describing what happens if the company is not able to make dividend

payments (as in "...the company may suspend payment of

dividends..."). If the company is unable to pay a dividend for a

non-cumulative preferred stock, they have no obligation to make the

missed payment up in the future; the dividend is suspended

(cancelled).

Conversely, the prospectus of a preferred stock with

"cumulative" dividends will often use the term "cumulative" when

describing the conditions under which the issuing company is allowed to

skip a dividend payment to you. The term "defer" is also commonly used

(as in "...the company may defer payment of dividends...").

Preferred stocks that offer cumulative dividends are therefore viewed

as having less risk since, in the event that the issuing company skips

a dividend payment, they still owe you the money; their obligation to

pay you accumulates. Such skipped dividends can be deferred

(postponed), but, short of a bankruptcy, they cannot be suspended

(cancelled).

This example shows examples of cases where the issuing

companies of these securities have ceased paying dividends to

shareholders (extraneous columns have been removed here for clarity).

Looking at the description for the issues from Freddie

Mac, Fannie Mae and the National Bank of Greece, you can see that these

are/were non-cumulative securities so the PSL Status column uses the

term "Suspended."

Similarly, the securities listed here from Anthracite

Capital and SuperTel Hospitality offer cumulative dividends so the

Status column uses the word "Deferred" to indicate the status of these

dividends.

The three most common rate of return calculations used by

preferred stock investors are Current Yield (CY), Yield-To-Call (YTC)

and Effective Annual Return (EAR). Each calculation uses different

assumptions and tells you something different about your investment.

Current Yield: CY is the yield metric that you

see whenever you view an online quote for a dividend-paying security,

including dividend-paying common stocks and preferred stocks. The CY

calculation assumes that you purchase shares today at today's market

price (the Last Price column) and never sell them. CY also assumes that

the issuing company never redeems your shares (the shares are never

called); that is, you hold your shares and collect the dividend income

forever (no capital gain or loss is ever realized). Further, CY does

not account for any additional gains you might realize if you

reinvested your dividend cash. The CY calculation assumes that the

dividends you receive provide no value to you whatsoever (you drop the

checks in the nearest shredder).

Yield-To-Call: YTC calculates the annual rate of

return assuming that you purchase shares today at today's market price

(the Last Price column) and that you sell your shares (back to the

issuing company in the event of a call or on the open market) on the

security's call date (the Call Date column) for a sell price reflected

by the security's par value (the Liquid Price column). YTC is a more

comprehensive metric than CY because YTC not only includes the rate of

return on your dividend income, but YTC also accounts for any capital

gain or loss you realize when you sell your shares. Further, YTC

assumes that each dividend payment that you receive is reinvested in

something that provides value to you whether you spent the dividend

cash or buy more shares with it. The YTC formula uses 'discrete compounding' to calculate

your return on reinvested dividends.

Effective Annual Return: EAR is the most accurate

and realistic rate of return calculation for preferred stock

investments. EAR is similar to YTC but uses 'continuous compounding' rather than

discrete compounding in its calculation. Continuous compounding is a

method that allows the EAR calculation to reflect reality much more

closely since it captures more of the return on your reinvested

dividends than the discrete compounding method used by YTC (this also

means that the EAR value will always be higher than the YTC value).

Our Preferred Stock ListTM

database program allows subscribers to see CY, YTC and EAR in

one mouse click. CY, YTC and EAR in

one mouse click.

By default, when a list of securities is displayed in the

View Table, the Yield column presents the Current Yield as indicated by

the letters "CY" seen in bold, black font just below the Yield column

heading.

To change the values in the Yield column to show

Yield-To-Call or Effective Annual Return, click on the letters "YTC" or

"EAR", respectively. Note that if you had previously sorted the View

Table by Yield, changing the type of yield calculation will change the

values in the column and the program will re-sort the list accordingly

using the new values.

Note that a value of "0.00%" will be presented for a

security when the yield calculation you have selected cannot be

calculated due to missing data. For example, neither Yield-To-Call nor

Effective Annual Return can be calculated for a security that has

already exceeded its call date. Similarly, "0.00%" will be displayed

for securities that have suspended or deferred dividends to

shareholders.

Just above the column headings on the left side of the

screen you will see a clickable feature that refreshes the data in the

View Table.

Some of the data

presented in the View Table is "perishable," meaning that it can become

out-of-date very quickly. For example, the Last Price column is the

market price of the last trade that took place on the stock exchange

for each preferred stock. The Volume value is also very perishable

since it shows you how many shares have traded so far today. Such

perishable values change continually throughout the day so refreshing

the data is important (note that this data is delayed about 20 minutes;

confirm all data before considering investing). Some of the data

presented in the View Table is "perishable," meaning that it can become

out-of-date very quickly. For example, the Last Price column is the

market price of the last trade that took place on the stock exchange

for each preferred stock. The Volume value is also very perishable

since it shows you how many shares have traded so far today. Such

perishable values change continually throughout the day so refreshing

the data is important (note that this data is delayed about 20 minutes;

confirm all data before considering investing).

To refresh the data in the View Table click Refresh.

Whenever Refresh is clicked, Preferred Stock ListTM returns to the Internet and updates the information

associated with the currently displayed list of preferred stocks in the

View Table.

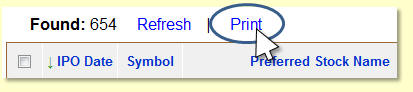

Just above the column headings on the left side of the

screen you will see a clickable feature that allows you to produce a

printed copy of the data in the View Table.

Clicking on Print

opens a new window on your screen with the View Table data presented in

a single table. In the upper-left corner of this new window is a Print

button that allows you to print the table on your printer. Clicking on Print

opens a new window on your screen with the View Table data presented in

a single table. In the upper-left corner of this new window is a Print

button that allows you to print the table on your printer.

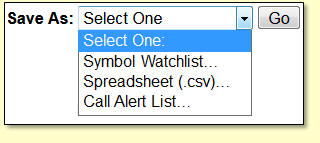

'Save As' Drop-down Menu Functions

Once you have the preferred

stocks that you are interested in showing in the View Table, you can

save them in any one of three forms - (1) as a 'Symbol Watchlist' for

later retrieval (what some refer to as a 'portfolio') or (2) as a

spreadsheet, with all of the displayed data, to your computer for

further analysis or (3) as a 'Call Alert List' if you want to receive

an email notification when/if the issuing company announces a call for

any one of these securities.

To see these three options

in the Save As drop-down menu click on the small down arrow.

A word of caution here: The

Save As / Symbol Watchlist feature and the Save As / Spreadsheet

feature involve downloading information to your computer and saving it

to your computer's hard disk. Doing so is entirely performed by your

web browser program (not our software). All web browsers perform the

task of downloading and saving a file to your computer differently. In

fact, depending on how you have your security settings configured, this

function may not work at all. Your web browser's security settings need

to be set such that downloading a file to your computer's hard disk is

allowed.

Some versions of Apple's web

browser (Safari) can be particularly picky about this and may disallow

saving a file to your computer as the default security setting when the

browser was installed onto your computer/device.

Before you attempt to save a

watchlist or spreadsheet file to your computer, be sure that your

browser's preferences and/or security settings do not block downloading

files. Your browser may not distinguish between cookies and any other

type of downloaded file so set your browser to never block

cookies.

Also, some browsers (such as

Safari) may preset the name of the folder on your computer that

downloaded files will be saved into (such as "Download" or

"Downloads"). If your browser is set to save downloaded files into a

specific folder, be sure that you know what that folder name is so that

you can find your downloaded watchlist or spreadsheet file later

(Safari users should look under Preferences/General).

Let's go over the three

options of PSL's Save As drop-down menu.

It is important to

understand the difference between saving a Symbol Watchlist versus

saving a Spreadsheet. It is important to

understand the difference between saving a Symbol Watchlist versus

saving a Spreadsheet.

When you use the Save As / Symbol Watchlist option

Preferred Stock ListTM saves the trading symbols

- ONLY - to your computer's hard disk in a folder and Symbol Watchlist

file name that you specify.

A Symbol Watchlist is a list of preferred stock trading

symbols and does not include their data. If you want to save the data

associated with the trading symbols as well, use the Save As /

Spreadsheet option (discussed next).

The Save As / Symbol Watchlist option is great if you

have lists of preferred stocks that you frequently want to watch. You

can create and save as many Symbol Watchlists as you'd like, just be

sure to give them unique and meaningful names on your computer so that

you can tell them apart when reloading them later (see the Securities

To View / Symbol Watchlist discussion above).

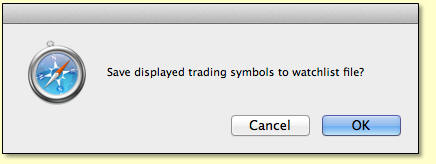

When you select the Save As / Symbol Watchlist option

and click the Go button, a window will open asking you to confirm the

action you want to take.

The appearance of

this window will be different depending on which web browser program

you are using and how you have some of your browser settings configured. The appearance of

this window will be different depending on which web browser program

you are using and how you have some of your browser settings configured.

The example at left is from Safari for Mac (once Safari

was configured to never block cookies using the

Preferences/Privacy/Block Cookies menu).

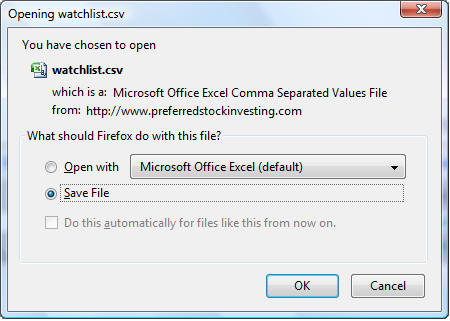

This example is from

Mozilla Firefox. For Firefox users, note the choices you are given

under the "What should Firefox do with this file?" question. This example is from

Mozilla Firefox. For Firefox users, note the choices you are given

under the "What should Firefox do with this file?" question.

Internet Explorer and other browsers produce a similar

Open or Save file confirmation screen.

Click Save File then the OK button.

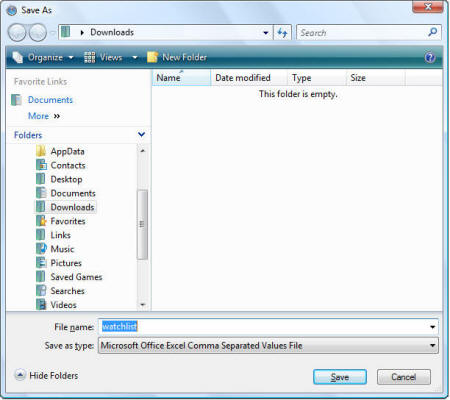

The Save As window will then appear, asking you to

designate where, on your computer, you would like to save this Symbol

Watchlist and under what file name.

Remember where you save it since you will need this

information again when you want to reload these preferred stocks into

PSL in the future.

By default, the file name is set to 'watchlist'. While

the file name can be changed to anything that is meaningful to you, do

not change the file type.

The file type is set to use the comma separated values

(CSV) format which is the format required for Symbol Watchlist files.

Changing the file type will prohibit your Symbol Watchlist file from

being able to be used by the Securities To View / Symbol Watchlist

option discussed earlier.

At some point in the future, you may want to make changes

to the trading symbols stored within a previously-saved Symbol

Watchlist. To make changes to the trading symbols within a symbol

watchlist file, retrieve your watchlist, make your changes, then

re-save it as follows:

- Use the Securities To View / Symbol Watchlist

option to retrieve the Symbol Watchlist file that you wish to make

changes to.

- With the preferred stocks from the watchlist displayed,

select the Securities To View / Enter or Edit Symbols to View option.

- The trading symbols from your watchlist will be listed

in the edit box. Make any changes to the symbol list.

- Click the View List button and PSL will display your

updated list of preferred stocks.

- With your updated list on your screen, use the Save As

/ Symbol Watchlist option to re-save your updated watchlist.

This option allows

you to save the data currently being displayed in the View Table to

your computer for further analysis. All three yield values (CY, YTC and

EAR) are included in the saved file. This option allows

you to save the data currently being displayed in the View Table to

your computer for further analysis. All three yield values (CY, YTC and

EAR) are included in the saved file.

When you select this option you will be asked to

designate the folder and file name under which Preferred Stock ListTM is to save this data.

The resulting file is in a special "comma separated

values" (csv) format that can then be opened by common computer

spreadsheet software programs such as Microsoft Excel or OpenOffice (free download for PC and

Mac).

The Save As / Call

Alert List option allows CDx3 Notification Service subscribers to

receive email notifications whenever a call is announced for specific

preferred stocks or ETDS. The Save As / Call

Alert List option allows CDx3 Notification Service subscribers to

receive email notifications whenever a call is announced for specific

preferred stocks or ETDS.

This feature is only available to CDx3 Notification

Service subscribers (when selected, you will be asked to

re-authenticate by entering your CDx3 Notification Service subscription

credentials).

Using this feature, the securities currently listed in

the PSL View Table will be saved as your 'Call Alert List' in our

system under the email address associated with your CDx3 Notification

Service subscription (where you receive CDx3 email messages from us).

When the issuing company of one of the securities on your Call Alert

List announces a call, you will receive an email notification from us

for that security.

Note that the trading symbols within your Call Alert List

can only be for securities that have yet to be called. PSL's far-right

Status column will display the word 'Called' for securities that have

already been called. The Save As / Call Alert List function will ignore

symbols for securities that have already been called when your Call

Alert List is saved since the call alert has already been sent to

subscribers for these securities.

To delete your previously-saved Call Alert List from our

system, use the Save As / Call Alert List option when the View Table is

empty (no preferred stocks listed). Saving an empty Call Alert List

tells PSL to delete your Call Alert List, if any, from our system.

At some point in the future, you may want to make changes

to the trading symbols within your Call Alert List. To make changes to

the trading symbols within your Call Alert List, retrieve your Call

Alert List, make your changes, then re-save it as follows:

- Use the Securities To View / From Your Call

Alert List option to retrieve your Call Alert List.

- With the preferred stocks from your Call Alert List

displayed, select Securities To View / Enter or Edit

Symbols to View.

- The trading symbols from your Call Alert List will be

listed in the edit box. Make any changes to the symbol list.

- Click the View List button and PSL will display your

updated Call Alert List.

- With your updated list on your screen, use the Save As

/ Call Alert List option to re-save your updated Call Alert List.

The data displayed by Preferred Stock ListTM

is provided by suppliers who do not warrant the data's completeness,

timeliness or accuracy. Therefore, no such warranty is offered to you

with respect to your use of Preferred Stock ListTM

or the data it presents. Confirm all information presented by Preferred

Stock ListTM prior to making investing decisions.

|