|

CDx3

Notification Service Website - Trends

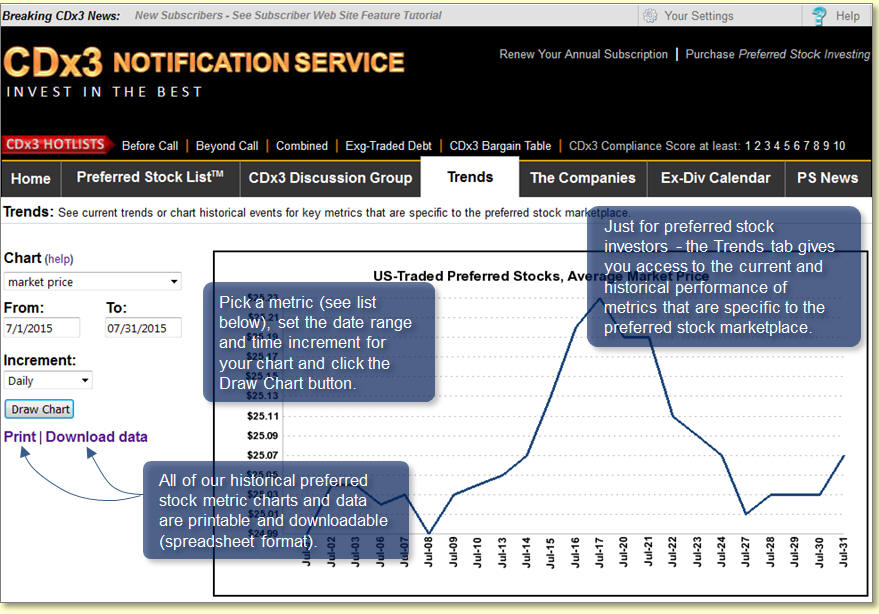

The Trends page on the CDx3 Notification Service website

is one of a kind. While there are lots of stock charting tools around,

this is the only one that is pre-loaded with metrics and data that is

specifically for preferred stock investors. And you can print your

chart or download our historical data, too.

The Trends page allows subscribers to graphically view

current trends, as well as the historical performance, of a wide

variety of key metrics that are specific to the preferred stock

marketplace. Here's how this page works:

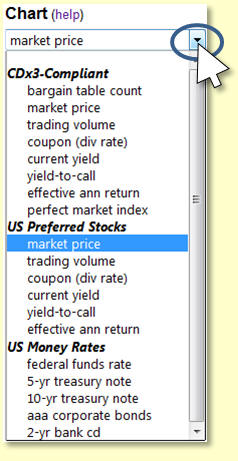

First, select the specific metric that you want to chart

using the Chart drop-down list. Just click on the little down-arrow and

the list of metrics available to be charted will appear in a scrolling

list.

Notice how these metrics are specifically tailored to the

interests of preferred stock investors. You can view the historical

performance of U.S. preferred stock coupon rates, yield-to-call,

preferred stock trading volumes over time, U.S. money rates and much

more.

The metrics, which include data for U.S.-traded preferred

stocks and ETDs, are organized into three groups:

- CDx3-Compliant:

These metrics are for the highest quality preferred stocks trading on

U.S. stock exchanges

(those that are able to meet the ten selection criteria

documented in Preferred

Stock Investing). We have collected data on the

performance of these

special securities for many years and allow you to chart,

print and download

much of it here.

- US Preferred Stocks:

This group of metrics reflects the characteristics of the overall

U.S. preferred stock

marketplace, including CDx3-compliant and non-CDx3

compliant issues.

- US Money Rates:

These rates represent the "cost of money" at various levels

throughout the

U.S. economy, starting with the federal funds rate, moving up through

treasury notes

and finally AAA corporate bond and bank CD yields.

The above example selects the market price for U.S.

preferred stocks.

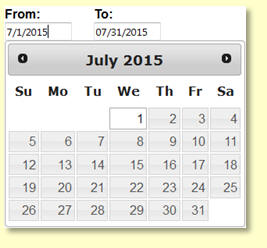

Now select

the date range for your chart by setting the From date and the To date.

You can either type in your dates or use the handy calendar tool that

will automatically appear when you click into a date field (and

disappear when you click out of a date field). Now select

the date range for your chart by setting the From date and the To date.

You can either type in your dates or use the handy calendar tool that

will automatically appear when you click into a date field (and

disappear when you click out of a date field).

The From date will default to the earliest date for which

our metrics database has data for the metric that you selected for your

chart. You can specify any From date you want as long as you do not

designate a From date that is earlier than the default value (the

oldest available data). Also, your From date cannot be greater (more

recent) than your To date.

Similarly, the To date can either be typed or you can use

the calendar tool that will automatically appear when you enter the To

date field. The To date defaults to today's date automatically, but you

can change it to any date you want as long as you do not specify a To

date that is prior to your From date or a To date that is in the future.

The Increment drop-down list will automatically populate

with a variety of time increments that you can select for your chart -

Daily, Weekly, Quarterly, Annually. The number of these increments that

are presented will depend on which metric and date range you have

specified for your chart (not all increments are available for all

metrics over every date range). The Increment drop-down list will

default to the most detailed time increment available for the metric

and date range that you have selected.

The example at the top of this page shows the daily

movement of the average market price of U.S. preferred stocks

(including ETDs) during July, 2015.

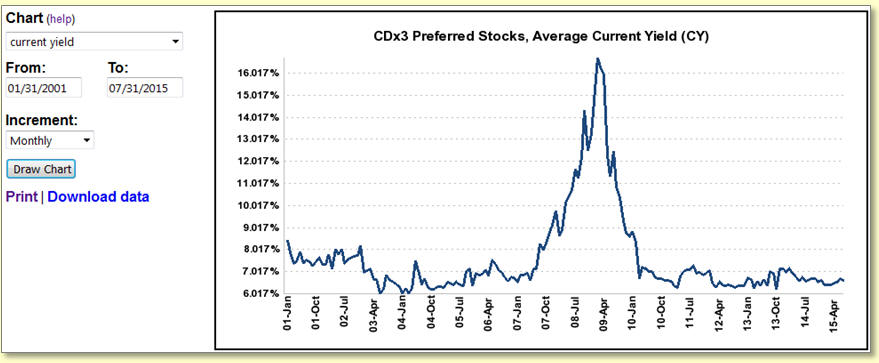

Below is a chart of historical interest to preferred

stock investors. This chart illustrates the average yield provided by

CDx3 Preferred Stocks (none of which have ever missed a dividend

payment) available on U.S. stock exchanges since January, 2001. The

massive returns realized during the Global Credit Crisis are hard to

miss on this chart.

The crisis years provided the highest dividend income in

history, not to mention spectacular capital gains, to those following

the preferred stock selection and investing method described throughout

Preferred Stock Investing.

|